北京冬奥会点燃冬季冰雪运动热情,与之相关的零售消费及度假体验更持续升温。哪座国内滑雪场最具自然禀赋与可持续发展潜力?第一太平戴维斯发布《韧性冰雪》专题报告,带你洞悉中国冰雪运动与滑雪度假的前景机遇。

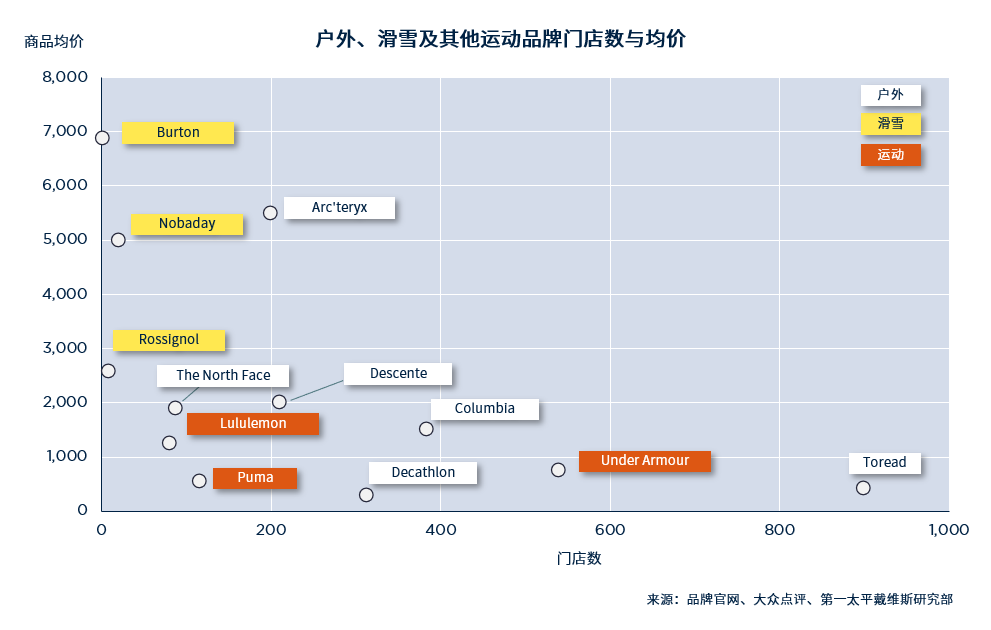

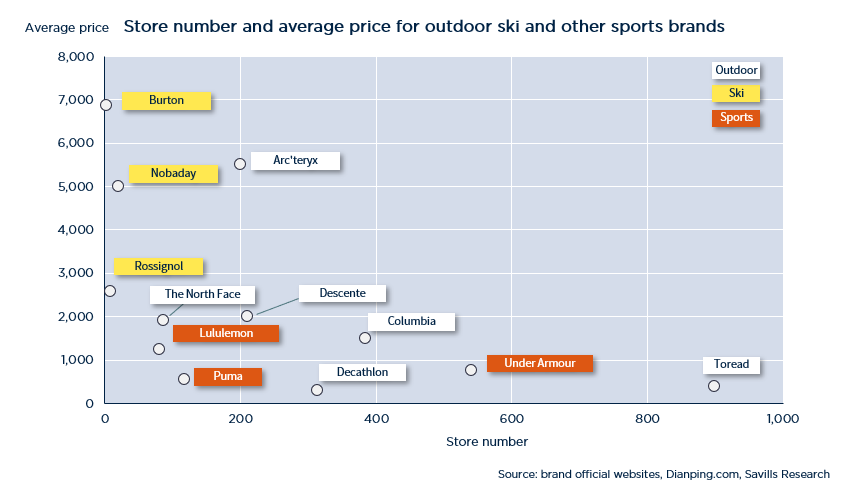

运动品牌门店扩张积极,而冰雪运动品牌虽然近年陆续进驻购物中心,但现有门店数量依然极少。

消费者对运动品牌的热情自疫情前就已有显现,行业销售额持续增长的背景下,运动品牌也保持好于大市的扩张速度。在国内主要20座一二线城市中,成熟运动品牌在2021年扩张速度达到8.0%,同比上升1.8个百分点,这一增速高于大众服饰品牌的2.6%。

随着越来越多的消费者开始关注小众细分领域,户外、滑雪、冲浪、潜水、滑板等运动项目正俘获更多年轻消费者的喜好,也带动功能性更强的相关品牌陆续增设门店。很多此前通过买手店或集合店出现在中国市场的品牌,近两年开店速度明显加快,陆续进驻购物中心开出独立实体门店。

在滑雪领域,滑雪服、冲锋衣、航海夹克等相关产品更加注重功能性与时尚的结合,商品均价数倍高于一般运动品牌及多数户外品牌,聚焦中高端消费人群。相对其他运动及户外品牌,滑雪品牌目前选址布局仍仅限于极少数大城市专卖店及热门滑雪胜地临时店,注重品牌形象传递。

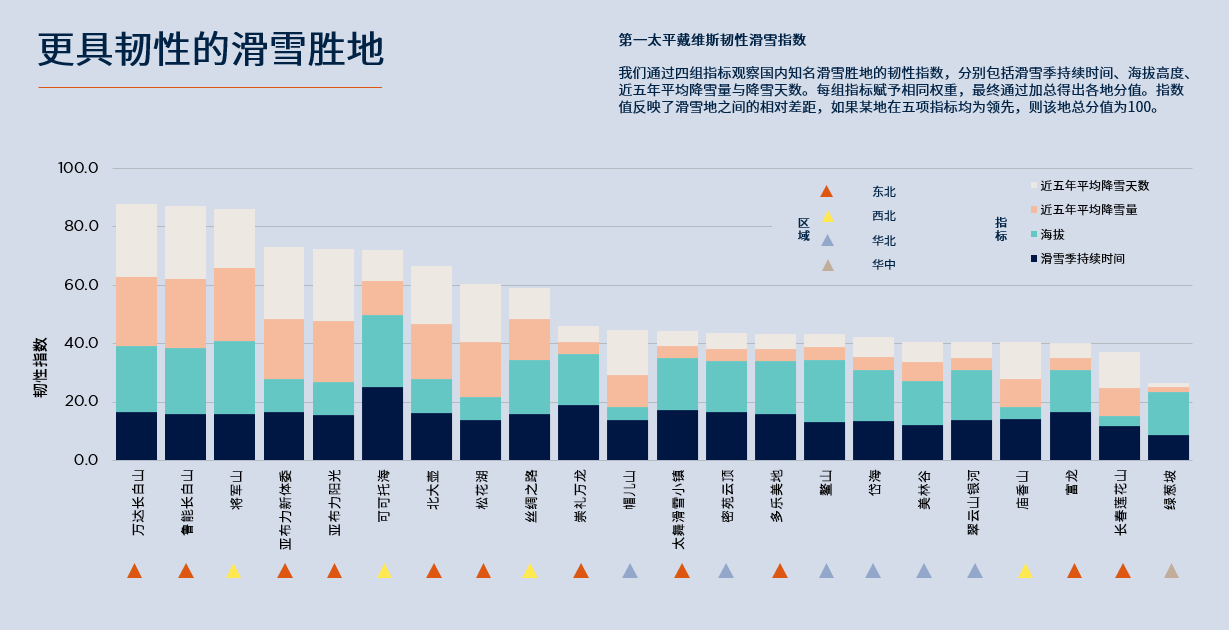

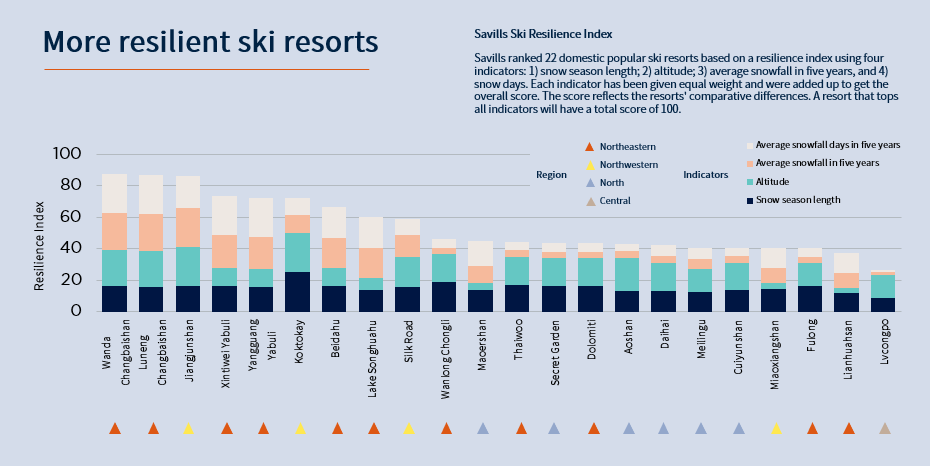

自然资源决定滑雪胜地的韧性表现。长白山、将军山及亚布力地区的度假雪场韧性指数领先。

自然资源是滑雪度假地的核心竞争力。在每年四到五个月的的雪季运营之外,滑雪场在其余时间多转为普通户外场地使用。但受制于大型滑雪设备布局及地理条件限制,非雪季的雪场运营与其他类型的旅游目的地相比,特色竞争力大为折扣。运营商面对挑战,除需不断提升雪季运营的竞争力,也应大力投资建设其他娱乐设施,以期实现全季候运营。从长远来看,实现可持续发展,拥抱环保理念,或将成为未来雪场竞争的全新领域。

第一太平戴维斯通过四组指标观察国内知名滑雪胜地的韧性指数,分别包括滑雪季持续时间、海拔高度、近五年平均降雪量与降雪天数。以此对国内22座具有拖挂式架空索道的滑雪胜地进行排名。

四组指标不仅数值较优、同时表现均衡的东北地区滑雪场展现明显优势。吉林长白山的雪季条件优越,冬季平均气温低,在22座雪场中降雪天数最多,其余指标同样排名领先,使万达长白山及鲁能长白山两座雪场分值最高。不过与其他东北地区相比,长春由于海拔及自然降雪量较低,雪场的韧性指数表现则相对较弱。

凭借最高海拔及近五年最高的年均降雪量,位于新疆阿尔泰的将军山滑雪场排名第三位。同样在新疆具有海拔优势的可可托海,具有22座滑雪场中最长的滑雪季,虽然在自然降雪量指标不占优势,但整体排名位于第六。

华北地区的六座雪场全部位于河北崇礼,因此在降雪量及降雪天数指标分值相同。其中崇礼万龙滑雪季持续时间更久,排名更为靠前,在22座雪场中位列11位。

第一太平戴维斯中国区市场研究部主管简可表示:中国“三亿人上冰雪”的倡议为冰雪运动及滑雪度假产业带来巨大机遇,有望成为未来消费增长亮点。更多消费者领略户外运动与大自然极致魅力,必将促使更多业主思考如何提升竞争力,以与国际知名滑雪胜地一较高下。

Tap into the Resilience Index for 22 domestic ski resorts – Savills published “Scaling the Summit” report

Beijing Winter Olympics lights up passion for winter sports as well as related consumption and need for such holiday experience. Which domestic ski resorts are the most potential and favoured by the nature? Savills’ “Scaling the Summit” report shares insight into opportunities in China’s winter sports and ski resorts.

Sports brand outlets are expanding proactively, but only a few winter sports brands have so far settled in shopping malls.

Consumers' enthusiasm for sports brands has started to show before the pandemic and as the sales go up, sports brands also expand faster than the general market. In the main 20 first and second-tier cities, mature sports brands are expanding at the rate of 8.0% in 2021, up 1.8 percentage points from 2020, which is higher than the 2.6% growth rate for common daily wear.

More consumers seek novel segments like outdoor, ski, surfing, diving, and skateboarding, leading such more functional related brands to set up more outlets. Those that previously entered the Chinese market through buyers' shops or brand collection shops are expanding further and faster, especially in the shopping malls.

Products like ski suits, winter jackets and sailing jackets give more emphasis on combining function and fashion, with prices all higher than common sports and outdoor brands, targeting mid- to high-end consumers. Comparatively, the ski brands are mainly spreading in the form of exclusive stores in the few big cities and temporary stores in the ski destinations for brand building.

Natural resources are key indicators of the ski resorts’ resilience. Changbaishan, Jiangjunshan and Yabuli regions top the ski resort index.

Natural resources are the core competence of the ski resorts. Apart from the four to five months snow season operation, the ski resorts are turned into regular outdoor venues in most cases. Ski resorts in the non-snow season are less competitive than other tourist sites due to their limited layout design for large ski equipment and geological conditions. Operators therefore should not only increase snow season competitiveness but also invest heavily in other entertainment facilities. In the long term, ski resorts will have to embrace a brand-new competition over sustainability and environmental protection.

Savills ranked 22 domestic popular ski resorts based on a resilience index using four indicators: 1) snow season length; 2) altitude; 3) average snowfall in five years, and 4) snow days.

Ski resorts in northeastern China performed well in all the indicators. Among the 22 resorts, the snow season in Changbaishan has the optimal condition with a low average temperature in winter and most snowy days. It also topped other indicators, ranking Wanda and Luneng resorts in Changbaishan first. Compared with other northeastern regions, however, Changchun, where Changbaishan is located, showed weaker resilience due to lower altitude and snowfall.

With the highest altitude and average snowfall in the past five years, Jiangjunshan in Altay Region, Xinjiang ranked third. Although Koktokay in Xinjiang has a similar altitude advantage and has the longest ski season, it fell behind the snowfall indicator and ranked sixth overall.

All six ski resorts in North China are located in the Chongli City of Hebei Province, so they scored the same on snowfall volume and snowy days. Since Wanlong Ski Resort has a longer ski season, it placed higher and ranked 11th among the 22 ski resorts.

James MacDonald, head of Savills Research China, said, “The advocate for 300 million Chinese people to enjoy the winter sports will bring a broad vision for the sports and ski resort industry. This may set to be a consumption highlight in the future. More consumers look to go for outdoor sports and get close to nature’s charm. It may prompt plenty of property owners to think about improving competence to rival with international counterparts.”